Business Insurance in and around Mt. Juliet

Looking for small business insurance coverage?

This small business insurance is not risky

- Mt. Juliet

- Murfreesboro

- Nashville

- Lebanon

- Antioch

- Franklin

- Brentwood

- Wilson County

- Davidson County

- Rutherford County

- Alabama

- Georgia

- Hermitage

- Hendersonville

- Shelby County

- Gallatin

- White House

- Smyrna

- LaVergne

- Watertown

- Music City

- Old Hickory

- Clarksville

- Nolensville

Help Prepare Your Business For The Unexpected.

Worries are unavoidable when you own a small business. You want to make sure your business and everyone connected to it are covered in the event of some unexpected catastrophe or trouble. And you also want to care for any staff and customers who stumble and fall on your property.

Looking for small business insurance coverage?

This small business insurance is not risky

Strictly Business With State Farm

Our business plans rarely account for every worst-case scenario. Since even your brightest plans can't predict natural disasters or consumer demand. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for uncertainty with a State Farm small business policy. Business insurance is necessary for many reasons. It protects your hard work with coverage like a surety or fidelity bond and business continuity plans. Fantastic coverage like this is why Mt. Juliet business owners choose State Farm insurance. State Farm agent Darian Horne, Sr. can help design a policy for the level of coverage you have in mind. If troubles find you, Darian Horne, Sr. can be there to help you file your claim and help your business life go right again.

Take the next step of preparation and get in touch with State Farm agent Darian Horne, Sr.'s team. They're happy to help you explore the options that may be right for you and your small business!

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

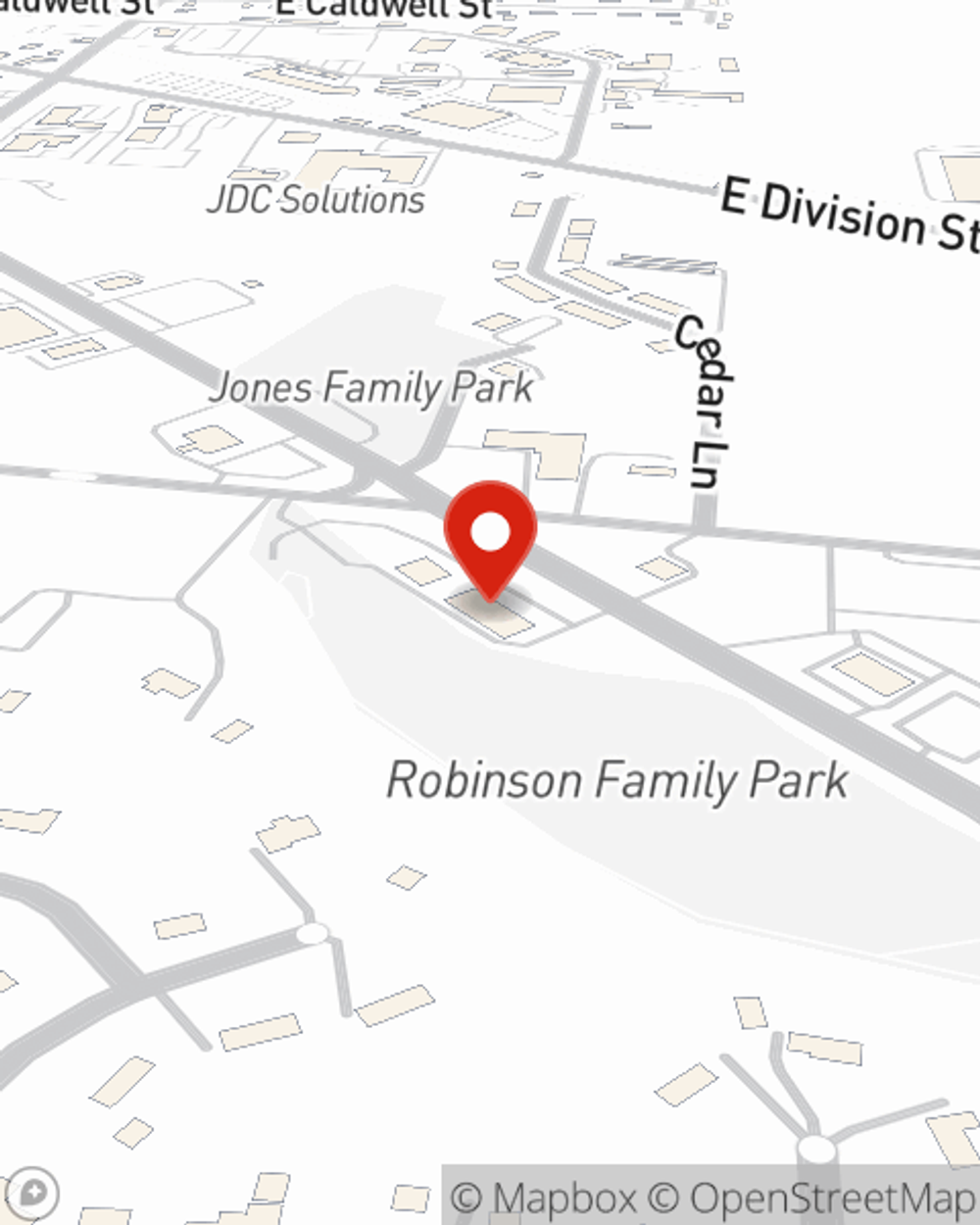

Darian Horne, Sr.

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.